Over 40 million Americans wake up with aching legs. The swelling gets worse as the day goes on. Standing for long periods becomes unbearable. These aren’t just minor inconveniences; they’re symptoms of varicose veins affecting nearly 24% of all adults.

Yet most people delay getting help. The concern isn’t whether treatment works, it’s whether they can afford it.

Here’s what changes everything: when varicose veins cause documented symptoms like pain, swelling, or skin changes, medical treatment typically qualifies for coverage. Studies show that 97% of medically necessary vein procedures get approved when patients follow the right documentation process.

The challenge isn’t convincing insurers to pay. It’s knowing exactly what they need to see.

What Insurance Plans Consider “Medical Necessity”

Major carriers follow specific criteria when evaluating vein treatment insurance coverage claims.

Symptoms That Qualify for Coverage:

- Persistent leg pain unrelieved by rest

- Heavy, dragging sensation worsening throughout the day

- Swelling that remains despite leg elevation

- Night cramps disrupting sleep regularly

- Skin discoloration near ankles

- Non-healing ulcers or bleeding varicose veins

These symptoms signal chronic venous insufficiency requiring medical intervention. If left untreated, varicose veins can lead to serious complications including skin ulcers and blood clots.

What Doesn’t Qualify:

Spider veins without symptoms, small varicose veins causing no pain or swelling and visual concerns about leg appearance. Without documented symptoms affecting daily function, expect to self-pay for spider vein insurance Northern Virginia claims.

The Conservative Treatment Requirement

Insurance requires proof you attempted conservative treatment first. This isn’t optional.

Required Conservative Measures:

| Treatment Method | Requirements | Duration |

| Compression Stockings | Medical-grade 20-30 mmHg or 30-40 mmHg | 6-12 weeks |

| Leg Elevation | Multiple times daily | Ongoing |

| Exercise Programs | Circulation-improving activities | Consistent |

| Weight Management | When applicable | As needed |

The Documentation Trap:

You need written prescriptions for compression therapy, purchase receipts for compression stockings, symptom diaries showing compliance and physician notes at each visit confirming adherence. Without this documentation, claims get denied regardless of symptom severity.

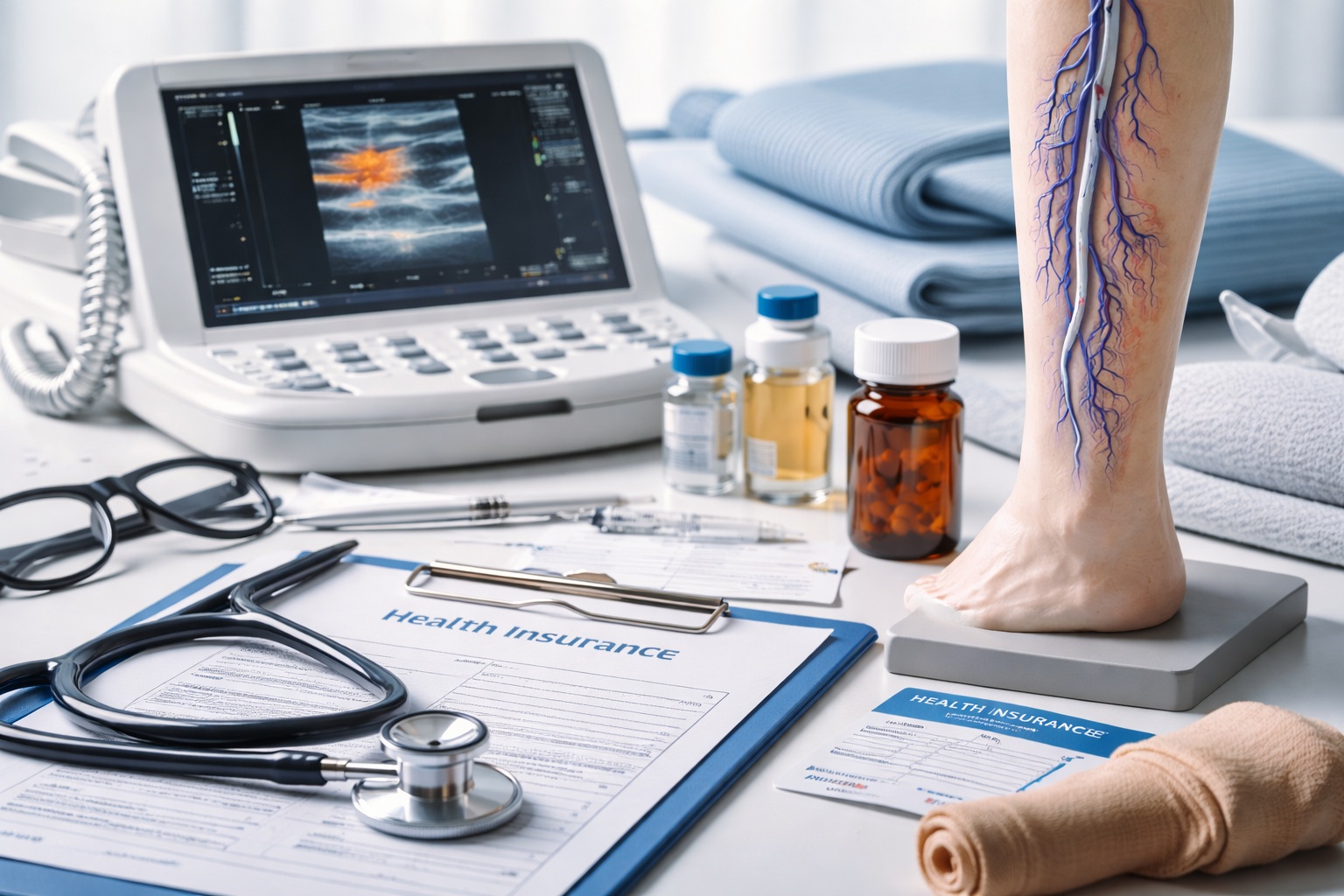

Diagnostic Testing Insurers Require

Insurance demands objective evidence from diagnostic imaging. A venous duplex ultrasound is standard, using sound waves to visualize blood flow and detect reflux. Insurers look for reflux lasting 0.5 seconds or longer in major veins, enlarged vein diameter indicating chronic disease and valve dysfunction.

Critical detail: Ultrasounds should occur while standing or with legs in dependent position. Some facilities perform these tests lying flat, missing significant reflux.

Insurance-Covered Vein Treatments

Usually Covered Procedures:

| Procedure | Method | Coverage |

| Endovenous Laser Ablation | Laser energy to seal diseased veins | Usually Covered |

| Radiofrequency Ablation | Radiofrequency energy to close veins | Usually Covered |

| VenaSeal | Medical adhesive to seal veins | Usually Covered |

| Ambulatory Phlebectomy | Removes bulging veins through tiny incisions | Usually Covered |

| Sclerotherapy | Treats tributary varicose veins | May Be Covered |

Different treatment approaches for bulging veins work better depending on vein size and location. Your vascular surgeon will recommend the most appropriate option based on your diagnostic imaging results.

Rarely Covered:

Spider vein treatment disappoints most patients. Insurance views spider veins as cosmetic regardless of quantity. However, when considering laser versus sclerotherapy for medically necessary varicose veins, both procedures may receive coverage if symptoms warrant treatment.

When Insurance Denies Your Claim

Denial doesn’t end your options. Many patients succeed on appeal with additional documentation. Your vascular surgeon can submit more detailed medical records, photos documenting condition progression and letters detailing how symptoms affect work ability. Some approvals come on second or third appeals.

Understanding Your Policy

Your policy contains specific vein treatment language. Review sections on medical necessity, cosmetic exclusions and varicose vein procedures.

Key Questions to Ask:

- Does your plan require pre-authorization?

- What are your deductible and copay amounts?

- Which vein specialists participate in-network?

- Are there specific documentation requirements?

Call your insurance company directly with your policy number and ask specific questions about coverage under your exact plan. Request written confirmation when possible.

Taking the First Step

Connect with a board-certified vascular surgeon experienced in navigating insurance claims. At Prime Vascular Care in Sterling, Virginia, we handle the entire insurance pre-authorization process. Most consultations provide clear coverage answers upfront.

Don’t let insurance uncertainty prevent evaluation. If your veins hurt, if swelling persists, if symptoms affect your daily life, you deserve answers.

Understanding your treatment helps you make informed decisions about your vascular health.